Blockchain The Opportunity for the Africa Market

The potential for blockchain technologies to open up new vistas for business and society has been widely discussed. But is there a chance that this revolutionary technology can help developing nations leapfrog more developed economies? Using the lack of existing infrastructure as an opportunity to adopt the most advanced methods has been a highly effective strategy for developing nations over the last few decades. The path to economic maturity across Africa remains less-travelled, with blockchain set to play a crucial role.

The potential benefits for a developing economy are extensive: increased transparency, more efficient and cost-effective transactions, and growth in local technological centres to build up infrastructure and export knowledge learned. The application of blockchain across Africa is not limited to finance. The technology is widely spread in such industries as self-sovereign identity, agriculture, energy, healthcare, insurtech, supply chain logistics and even to the creator economy for NFT’s (non-fungible token).

Understanding blockchain technology

Simply put, a blockchain is a decentralized ledger of all transactions deployed via cryptographic mechanisms across a peer-to-peer network. Using this technology, participants can confirm transactions without a need for a central clearing authority. With blockchain, records are simultaneously and almost instantaneously written in different computers at different locations rather than on the computer of one individual, agency or organization. Undoubtedly, this provides a lot of advantages when compared to the regular mode of storage.

Every transaction, every process, and every payment on the blockchain has a digital record and signature that can be identified, validated, stored, and shared. This technology has the potential to almost eradicate the need for such intermediaries as brokers, bankers or lawyers, thanks to the ‘decentralized’ nature of the technology.

Blockchain also strengthens and ensures the integrity of the records kept. This is particularly vital in this age where there are a lot of attacks carried out on web servers by spurious individuals. With blockchain, there exists a strong resilience because the records are always safe as long as they still remain accessible to other parties.

The impact of blockchain on Emerging Markets

Emerging markets may be poised for a more rapid adoption of blockchain due to their underbanked populations, higher banking risks, and lower bank penetration. Unlike developed economies where financial services are sophisticated and offer adequate comfort, convenience and safety measures to service and protect retail consumers, the large percentage of financial service providers in such emerging markets as Africa and some parts of Asia are largely still limited.

However, with the decentralized nature of blockchain and its increased transparency, this trend can be reversed. The mere fact that blockchain ensures that parties ideally have a shared interest in maintaining the system and automation greatly reduces the weight that would have been borne by a single entity since the records have now become immutable and everyone is involved.

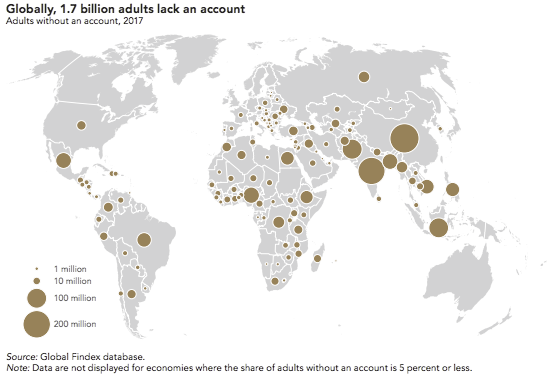

According to the World Bank, there are 1.7 billion unbanked adults worldwide, down from 2 billion in 2014. These adults do not have a bank account or a mobile money account with a traditional financial institution. In the Sub-Saharan region, an estimated 95 million unbanked individuals receive cash payments for agricultural products, while about 65 million save via semi-formal methods.

To help achieve progress towards financial inclusion, the World Bank recommends that policies such as a digital ID be implemented and mobile financial services be allowed to thrive in these regions. Incidentally, these steps are largely hinged on blockchain technology.

Blockchain’s potential applications may extend beyond the financial sector, with benefits for global value chains that span borders and connect developed and developing countries, as well as agriculture and pharmaceuticals, among other industries. It can also accelerate the adoption of clean, affordable, reliable, and resilient energy sources in emerging markets.

As more people continue to tap into the potential of blockchain technologies, one can expect a consistent rise in business models designed to exploit the vast use of this technology yielding in a drive for innovative systems and enhanced data security.

The rapid adoption of blockchain in Africa

The rapid adoption of blockchain in Africa

A World Bank report revealed that a large part of the income for many African countries come from remittances sourced abroad. Although these remittances were as high as 48 billion dollars in 2019, the World Bank notes that the transaction costs are significantly higher than in other regions, ranging from 8% to as high as 20%.

This has led to a transition that has seen remittances migrate increasingly to alternative platforms. The reason is obvious as sending money via these platforms comes with little or no cost to both parties. It is even more secure, and in most cases, is faster. Added to this is the advantage that comes with avoiding currency conversion charges which can be punitively high.

Almost 60% of the African population are under the age of 25, boasting the youngest population in the world. This burgeoning youth population is backed by a very active smartphone penetration rate that keeps on growing. There is a ripe and ready tech-savvy population on the African continent who are able to leverage the benefits of the blockchain.

Blockchain use cases

Many people think of blockchain technology only in terms of Cryptocurrencies and Bitcoin. However, its unique features of immutability and transparency have made it receive many applications in a wide variety of industries.

In the healthcare industry, for example, blockchain is repeatedly being used to help ease procedures while ensuring the security of such sensitive information as patient medical history. This is especially important because such data is primarily stored in a centralized manner by the hospitals, making them easy targets for data breaches and hacks. Blockchain can thus help both health providers and patients to easily, quickly and safely exchange information through encrypted codes.

This is what firms like Ubrica and TraceRX seek to do. TraceRX uses blockchain to help international aid organizations have complete information about the supply of pharmaceuticals and get notifications in such issues as an excess, any supply stock change or if any unscheduled stops were made during transportation.

In agriculture, the main application of blockchain has been with regard to creating immutable records of land ownership for farmers. Land LayBy, a Kenyan startup does this by using an Ethereum based shared ledger to keep records of land transactions, thus creating a secure platform such that those looking to buy land can log in to interact with the current owners. Also, Land LayBy has made provisions for these farmers to use this medium to obtain credit from banks or alternative financing companies.

From loans and investment products to remittance networks, blockchain-enabled solutions have already begun to change the trajectory of financial inclusion and other developmental sectors. And with the continent’s venture capital market set to expand against a backdrop of consistent economic growth, the conditions are right for an economic transformation.